The aim of today’s post is to provide some insight into the genuine customer experiences of people who have used Chapka Insurance. We’ll be covering both positive and negative online Chapka Insurance reviews, as well as the benefits of their policies and coverage.

Hopefully, you’ll be able to use this information to make an informed decision on whether Chapka Insurance is right for you, and whether their various policies meet your needs as a traveller.

To give you a quick idea of the experiences people have had with Chapka Insurance, I’ve summarised their online reviews in July 2025:

- Chapka Insurance has an average rating of 4.7/5 on verified-reviews.co.uk.

Chapka offers a wide range of policies suited to different travellers. Today, we’ll be focusing on their policies designed for short-term trips, long-term and backpacking trips, working holidays, students, and annual travel.

My opinion on Chapka Insurance

I never thought I would have such a frightening experience while travelling, but while in Vietnam, the worst happened. I began suffering from a terrible eye infection, and after being admitted to hospital, the doctors told me they were unable to treat me there.

Obviously, when a problem like this occurs, we don’t necessarily know how to react. If you’re insured, however, you just need to follow a simple principle. Always keep your supporting documents, or your claim may be rejected!

Luckily, I was able to provide this proof, and I recovered the costs of my emergency repatriation and medical treatment.

All you have to do is prove to Chapka that you had an accident, the nature of the accident, and the amount of the expenses related to the accident. The same is true for car accidents or thefts: the police report will be requested by any insurer.

Chapka Insurance reviews

In the following paragraphs, I’ve compiled and summarised a variety of online reviews made about Chapka. This is to give you an idea of real users’ experiences with Chapka’s services.

Reviews of Chapka Insurance on TrustPilot

TrustPilot is one of the world’s leading online review platforms, which shows users’ reviews of goods and services from around the world.

Trustpilot receives almost 1 million new reviews each month, and in the case of Chapka, there are 70 total reviews at the time of writing this post.

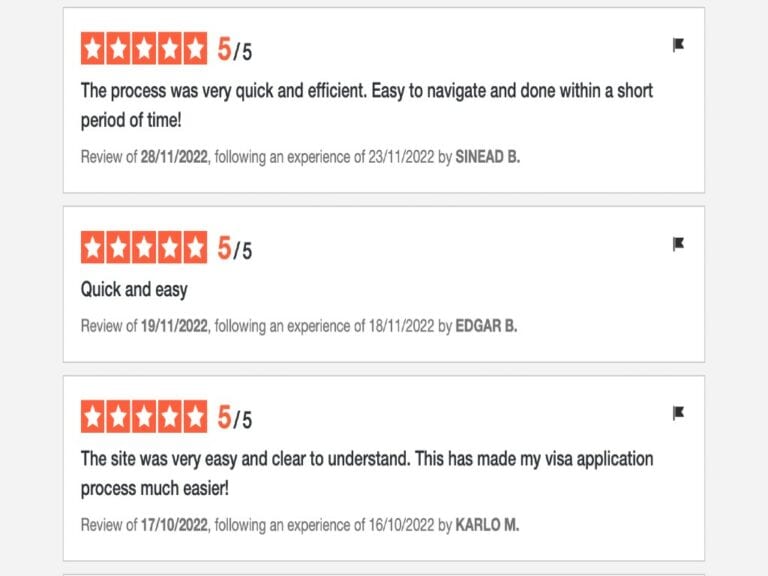

✅ Positive reviews of Chapka on TrustPilot

- Quick and efficient claims process

❌ Negative reviews of Chapka on TrustPilot

- Slow response times

- Claims rejected on a technicality

I think that the fact that there are only 70 TrustPilot reviews for Chapka makes it a little difficult to draw any conclusions. Let’s take a look at another review forum, verified-reviews.co.uk.

Reviews of Chapka Insurance on Verified Reviews

At the time of writing this post, Chapka has 129 reviews on verifiedreviews.co.uk.

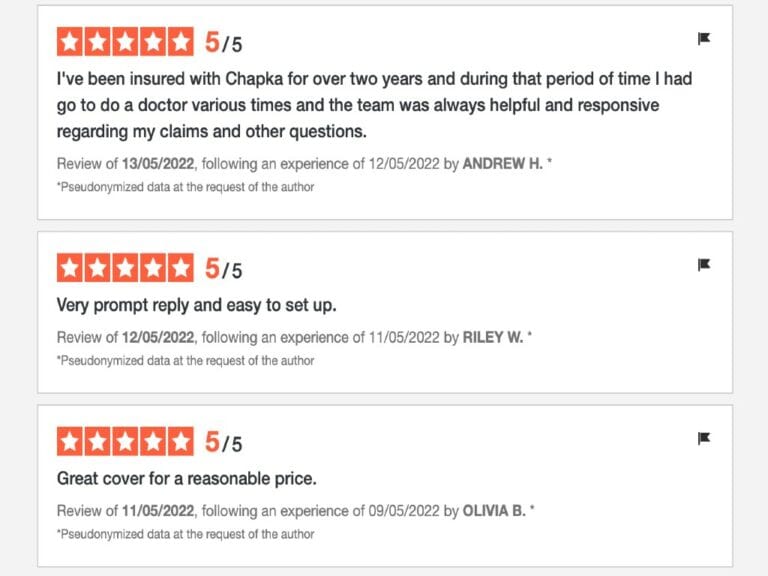

✅ Positive reviews of Chapka on Verified Reviews

- Friendly and helpful customer service representatives

- Straightforward application process

- Affordable

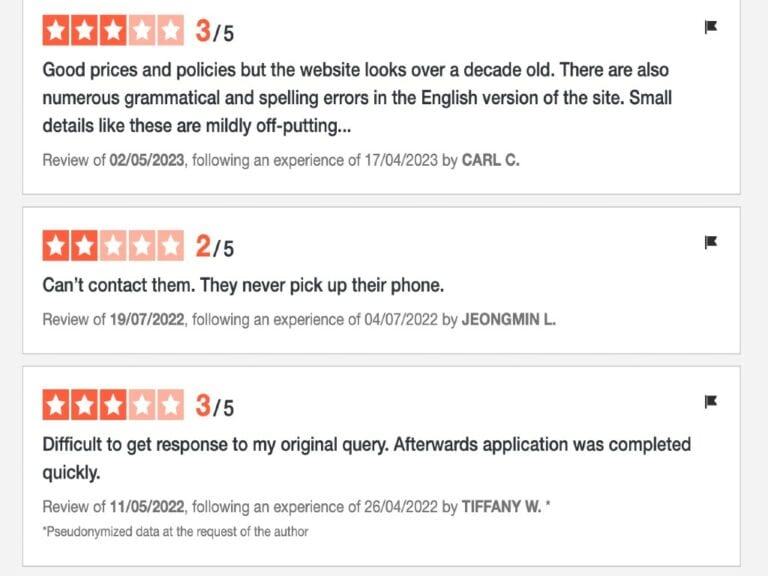

❌ Negative reviews of Chapka on Verified Reviews

- Slow response times

- Website not mobile-friendly

Personally, I don’t think there are enough online reviews of Chapka out there to make a decision merely on this basis.

So, to give you further insight, I’ll be sharing my own experiences with Chapka, as well as some information about their policies and their benefits.

Which is the best Chapka policy for me?

When selecting an insurance policy, it’s vital that you consider all the possible risks related to the trip you’re taking, so you can prevent being uninsured for a potential incident while abroad.

Aside from possible risks, you should also carefully consider what your personal needs are as travellers, so you can ensure you get the right level of coverage based on those needs.

Having a good idea of which traveller profile you fit into is crucial when taking out insurance. So, let’s take a look at the best Chapka policies for the different traveller profiles in July 2025:

Policy | Discount |

Cap Assistance, for short trips and holidays of less than 3 months | |

Cap Adventure, for long holidays and backpacking trips. | Policy Link |

Cap Annual Assistance, covers all trips of 90 days or less for an entire year. | Policy Link |

Cap Working Holiday, ideal for working holiday trips and gap years. | |

Cap Student, ideal for student exchanges. |

All discounts will be applied automatically when you use our links.

How does Chapka Insurance work?

It’s simple. If you take out a policy with Chapka, you can make a claim on this insurance if something goes wrong while abroad, and receive reimbursement for the costs. A real life-saver!

To recover the costs of medical treatment abroad, for example, simply print out the online form on the Chapka website. Then, go to the hospital and present it to them, and they will provide you with all the supporting documents you’ll need to make a claim with Chapka.

All insurers require this document signed by doctors to trigger reimbursement of expenses. If you can’t print documents on the spot, keep the supporting documents: medical reports, declaration, detailed invoices, etc.).

Also, it’s incredibly important to declare any pre-existing conditions when contracting. If you follow all these steps, you are likely to have a successful claim with Chapka.

What are the benefits of Chapka Insurance?

Chapka Direct is perhaps not the cheapest insurance company on the market. But it does offer excellent coverage, and a range of useful services that aren’t covered by many other insurers.

For example, there are few insurers with as many different policies as Chapka. This means that each policy is perfectly suited to its target audience, meaning you’re getting the best coverage.

Another stand-out feature of Chapka is their medical coverage. Depending on the plan you choose, you can even get unlimited medical expenses covered for, making it perfect for the adventure sportspeople.

With Chapka Cap Adventure, you can also make use of a 24/7 medical teleconsultation service.

Chapka Insurance coverage

In this section, I’ve summarised the most useful benefits that Chapka has to offer:

- 🚑 Extensive medical coverage, and in some cases, medical coverage during trips home to your country of residence.

- 🧳 Baggage compensation in the event of lost or stolen belongings.

- ✈️ Repatriation and early return.

- 🦠 Covid-19 coverage, with a wide range of cancellation causes.

- 🏄♂️ Broad coverage for sports and adventure activities.

- ⛑ Search and rescue expenses.

Personally, I prefer to pay a few extra euros to be covered for risky sports or activities, or for high medical expenses, as most countries have exorbitantly high medical costs for foreigners.

I personally find Chapka to be a fantastic insurer. However, you should know that Chapka’s policies are only available to residents of the European Union and French Territories, but keep reading! You’ll find information about other great insurers below.

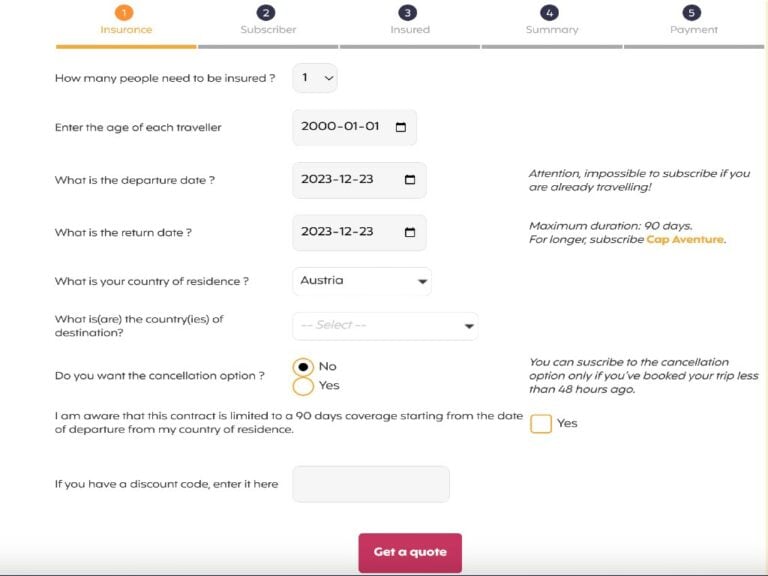

How to contract Chapka Insurance

The Chapka website is easy to navigate, and taking out a policy with Chapka is a straightforward process. To give you an idea of how it works, I’ve created a step-by-step guide.

1️⃣ Click here to be redirected to the Chapka website.

2️⃣ Select a policy, and fill in the details of your next trip.

3️⃣ Then click on “Get a quote”.

4️⃣ Fill in your personal and payment details, and you’re done!

Remember, if you click on any of the Chapka promo code links featured on our blog, your discount will be applied automatically.

Travel hacks to help you save on your trip

There are countless ways to make your travels cheaper. Chapka offers some great discounts, which is great, but there are plenty of other ways to reduce the cost of your trip.

Choosing insurance that is tailored to your needs is vital, but remember that flights and accommodation are crucial factors as well.

Here are a few tricks I’ve learned over the years, they’ll help you save money on your travels, so you can focus on the travels ahead.

If you follow these tips, you might just find that by the end of your trip, you have enough money left over to extend your trip or even explore an extra destination on your route home!

- Find cheaper flights

You can reduce the cost of any flight thanks to AtlasVPN, which conveniently presents you with the best prices on comparison sites like Skyscanner. Simply relocate your IP address to on the of the following countries, and start your search!

- Turkey

- Malaysia

- Thailand

- India

- Mexico

This tool is usually expensive, but we have an incredible discount for you that you can activate here.

- Find discounted accommodation

Finding cheap accommodation these days can be a challenge, but with Booking, you can find some great deals.

Booking is the best platform for finding accommodation anywhere in the world. Its main advantage? The many discounts you can get for becoming a Genius member! Register with Booking now to save on accommodation.

My opinion on other insurance companies

If you’re not sure whether Chapka is right for you, not to worry! There are plenty of other reliable alternatives are out there.

We have tried and tested all the best travel insurance policies and written comprehensive reviews on each of them.

You can check out our travel insurance comparison article here.

|  |  |

|---|---|---|

⭐️⭐️⭐️⭐️⭐️ | ⭐️⭐️⭐️⭐️ | ⭐️⭐️⭐️⭐️ |

Heymondo Insurance | Chapka Insurance | IATI Insurance |

|  |  |

|---|---|---|

⭐️⭐️⭐️ | ⭐️⭐️⭐️ | ⭐️⭐️ |

SafetyWing | World Nomads | ACS AMI |

Frequently asked questions about Chapka Insurance

What are the means of payment for Chapka Insurance?

Chapka receives online payment by credit card, with guaranteed security.

If you are unable to do this, Chapka does offer the opportunity to pay by personal cheque, although this is a time-consuming process. For more information, see Chapka’s official website.

Why take out a travel insurance policy with Chapka?

Insurance companies who have spent many decades in the industry, such as Chapka, understand the needs of travellers.

Some credit cards such as Visa Premier or Mastercard Gold offer travel insurance too, but these cards do not cover all situations in the event of a claim. In most cases, medical visits are not covered, and your luggage is not covered by your credit card insurance.

Finally, reimbursement is often complicated and slow. This is why we always recommend opting for a traditional insurance provider.

After having tried countless travel insurance plans over the years, I generally opt for Chapka as I have only had positive experiences with them. There are even a number of exciting Chapka promotional offers in July 2025.

Is taking out Chapka Insurance worth it?

Chapka offers travel insurance policies for virtually all types of trips, each one tailored to the needs of travellers embarking on that type of trip, from short-holidays, to adventurous travel.

So, whether you’re a backpacker, student, working holiday-goer, frequent traveller, or whether you’re simply craving another holiday, Chapka has a plan that will provide you with a financial safeguard if something goes wrong while abroad.

To be sure that Chapka is right for you, you need to consider your needs as a traveller, and take the time to read through the chosen policy’s terms and conditions before contracting. With this part done, you’ll be able to contract your insurance and start travelling.

I hope this Chapka Insurance review has given you the information you need to make an informed decision. After all, taking out insurance may be the most important investment you ever make!