With the advent of neobanks, new alternatives for business banking are appearing. They are more convenient, cheaper than traditional banks and sometimes even free of charge, meaning you can prioritise more time to managing your business.

There are several platforms for transferring money and managing accounts in various currencies. Some are more effective than others, and among them, Wise stands out for its reliability, efficiency, and reasonable fees.

Below, I will cover all the how-tos of Wise Business as well as some online opinions, but first I would like to give you a quick summary as a guide:

- Wise offers integration with platforms such as Xero.

- Wise stands out for offering batch payments, an open API and the benefits of its business debit card.

- Wise is ideal for sole proprietorships and freelancers, as well as public entities and limited liability companies.

How does Wise Business work?

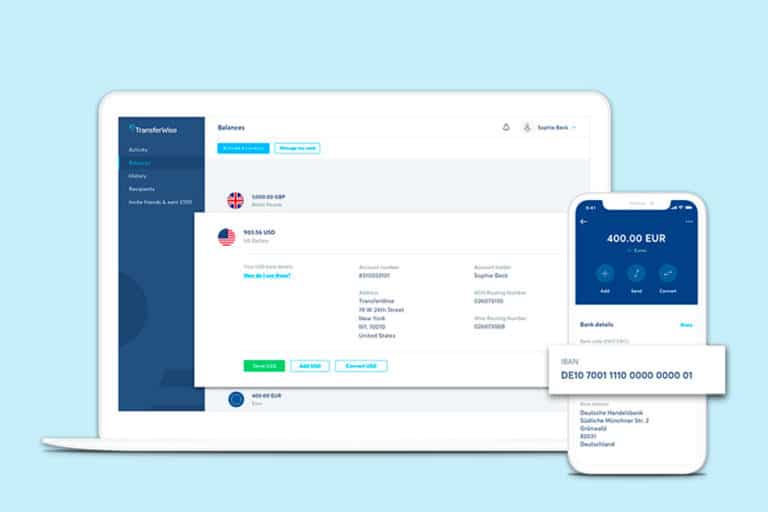

The Wise Business account is a multi-currency account. Its main advantage is that it allows you to transfer money anywhere in the world quickly and easily. In other words, you can make and receive payments worldwide at the real exchange rate.

The Wise account for businesses also allows you to pay bills, buy shares, and manage the payroll of employees in approximately 70 countries.

Transfers are made in euros, dollars, and plenty of other currencies. The website interface is also intuitive and convenient, allowing you to do everything with just a few clicks.

It is managed exclusively online and works with the following currencies, just to name a few:

- 🇪🇺 Euro: with IBAN account number, bank transfer number, SWIFT / BIC bank code and routing number (ACH or ABA).

- 🇬🇧 Pound Sterling: with IBAN account number (to receive only UK GBP and sort code)

- 🇺🇸 US Dollar: with account number, bank transfer number, SWIFT / BIC bank code and routing number (ACH or ABA).

- 🇦🇺 Australian dollar: with account number and BSB code.

- 🇳🇿 New Zealand Dollar: with account number.

- 🇵🇱 Polish Zloty: with account number.

Thanks to its API, it is possible to connect Wise to any e-commerce platform and some professional accounting tools (works with Xero).

It is also possible to automate payments and workflows. In addition, the API allows you to connect any account to automatically synchronise data and simplify your accounting work.

Of course, Wise meets the security criteria and banking regulations, and are registered with numerous financial authorities in all the countries in which they operate.

How to open a Wise Business account

It takes approximately 8 minutes to open a Wise Business account, and you only need to enter your personal details and business details. In other words, you can manage your business online with just a few clicks!

The verification process is quick and easy, simply provide your ID and home address. This process typically takes 2 working days. Once Wise has verified your business, you can make and receive international payments, and apply for a bank card.

To open a Wise account for your business, you first need to create a profile, for that, you need to:

- Access the official Wise website.

- Click on “Open your account”.

- Log in or enter an e-mail address.

- Select your company profile.

Finally, Fill in the requested information.

Once you have opened your account, Wise will verify your identity and that of your company. The entire process takes between 4 and 7 working days.

Wise fees and prices for companies

The main fees paid by businesses when using Wise, are:

- 50 € for opening the account.

- From 0.43% on money transfers and conversions.

- 2 free ATM withdrawals up to €200.

- 1.75% for withdrawals over €200 (+€0.50 for each withdrawal).

- 4€ for obtaining the Wise Business Card.

✅ Advantages of Wise Business

- Conversions are carried out at the real market rate in more than 40 currencies.

- Unlike PayPal, which inflates your exchange fees, Wise Business allows you to save on transactions.

- It is completely free to receive money in major currencies such as EUR, USD, GBP, AUD or NZ.

- With Wise Business, the fees are around 0.4% of the transaction amount.

In addition to these advantages, the Wise Business account stands out for:

- Integration with Xero. Xero and other accounting software can be connected.

- Batch payments. Multiple payments can be sent in a single transaction.

- Open API. Allows you to automate payments with the dedicated Wise Business API.

- Monthly statements. Statements can be downloaded for each transaction.

- Mastercard bank card. The multi-currency account is linked to a Mastercard debit card accepted worldwide. It is free of charge.

- Cannot be used if the business is related to cryptocurrencies, tobacco, or adult content

- You must pay 50 € to open the account

- The website is slow at times, due to the high number of users.

Having used the service for some time now, I am convinced that the advantages greatly outweigh the disadvantages. Of course, each person and each business has its own unique needs, so it’s important to read reviews and evaluate the pros and cons yourself.

Opinions on Wise Business

In general, there are positive and negative aspects on which many real users of Wise Business seem to agree on. I have summarised these points here:

- Everything can be done online: both receiving and paying and transferring money.

- It is very easy to connect the account with the company.

- No hidden fees that appear at the “last minute”.

- You have to pay to set up the account.

- Some users comment that they have had their account blocked for no apparent reason.

Is Wise Business worth it?

Founded in the United Kingdom, Wise is known for its innovation in the field of financial transactions.

It has become a financial institution that facilitates the process of international bank transfers, without paperwork and bureaucracy. The reason for this success? Wise offers exchange rates up to 19 times cheaper than PayPal and traditional banks.

Wise for Businesses works for freelancers, e-commerce, small and medium-sized businesses and large businesses.

It is especially recommended for sole proprietorships and freelancers, public companies and limited liability companies, as well as charities in the European Economic Area (EEA), Canada, the United States and the United Kingdom, Switzerland and New Zealand.

On the downside, Wise does not cover for certain business activities. On their website, they provide the full list of prohibited activities.

Frequently asked questions

In addition to the things I’ve mentioned above, the main concerns of business people concern security, and Wise’s ability to cancel transfers. So, let’s take a closer look at these questions.

Is Wise for Business secure?

Wise is 100% secure and guarantees the security of international transfers.

I have already made almost 30 transfers in different currencies and countries and, every time, time, it has gone smoothly. In fact, sometimes the money arrives in the account faster than the advertised time.

Can I send money to someone if I don’t know their bank details?

In some cases, yes!

If you want to make a bank transfer to someone, but you only know their e-mail address, Wise can do the hard work for you. If the person has a Wise account already, then Wise can help track down their bank account details for you.

If they don’t have an account with Wise, Wise will send them an email and request the necessary information to make the transfer. If the recipient doesn’t accept the transfer within 7 days, Wise will send the money back to your account.

Note that when you’re sending money in the following currencies, you will need the recipient’s bank details to make a transfer:

- From Brazilian Real

- From Indian Rupee

- To Peruvian Sols

- To Colombian Pesos

- To Chinese Yuan

- To Ukrainian Hryvnia

- To Ghanaian Cedi

- To Sri Lankan Rupee

- To Bangladeshi Taka

- Sending US Dollars to a bank account outside of the United States

How to send money using a link

Wise also allows you to make transfers using an online link, which doesn’t require you to know the recipient’s bank details.

It’s quick and easy, you just need to follow these steps:

- Go to your Wise balance, choose and amount and select “Send”.

- At the bottom of the page, click on “Share a payment link”.

- Once you’ve clicked on “Confirm and send”, you will be able to copy the link and send it to your recipient.

- The recipient then just needs to enter their Wise account and click on “Claim”, and the transfer will be completed.

Knowing you can send money quickly and safely without knowing the recipient’s bank details is another great advantage of using Wise.

How do I cancel a transfer from Wise Business?

Almost all transfers can be cancelled, depending on the progress of the transfer.

If the payment has not yet been made:

- Log in.

- Click on “Activity”.

- Choose the transfer you want to cancel.

- Click on “Cancel the transfer”.

If the payment has already been made, it is still possible to cancel if the money is still withheld by Wise. In this case, the option “Cancel transfer” will no longer appear in the profile, and you will have to contact Wise.

The transaction cannot be cancelled when the money is already in the beneficiary’s account.

I hope that this post about Wise Business has given you some valuable insight into the world of internet banking that will help you reach a decision on whether Wise is right for you. If you have further questions, feel free to get in touch!