When travelling, accidents and health risks are numerous and often unknown.

With the pandemic, some countries now require proof of insurance to cross the border, so ultimately, it’s simply best not to take the risk!

That’s why I’ve created this guide to the online ACS AMI insurance reviews, to provide some insight, so you can make an informed decision on your insurance for your next overseas adventure.

Before delving deeper into the content, including an overview of ACS AMI’s benefits, FAQs, and its best policies, here’s an overview of their online reviews:

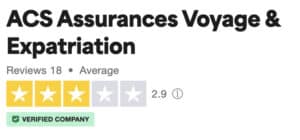

- ACS AMI has an average score of 2.9/5 on TrustPilot

My review on ACS AMI insurance

My own personal experience has shown me that a simple eye infection can lead to an emergency repatriation. For 30 years, ACS AMI has demonstrated its reliability and experience in multi-risk coverage abroad.

Needless to say, I have been satisfied with their coverage. As such, I would like to point out a few of the pros and cons of ACS AMI from my experiences with them.

✅ Advantages of ACS AMI insurance

- ACS AMI’s tariffs are the lowest on the market.

- There is no increase in insurance premiums for the USA.

- ACS AMI has 30 years of experience and presence in the travel insurance market.

❌ Disadvantages of ACS AMI insurance

- Luggage is only insured during travel.

- The early return of a family member in case of hospitalisation is not included in the insurance offers.

ACS AMI insurance reviews

ACS AMI insurance reviews on TrustPilot

TrustPilot is one of the world’s leading online review platforms, giving users the opportunity to share their thoughts and experiences about businesses from around the world.

Trustpilot receives almost 1 million new reviews each month, but at the time of writing this post, ACS AMI only has 18 total reviews. Their Trust rating is 2.9.

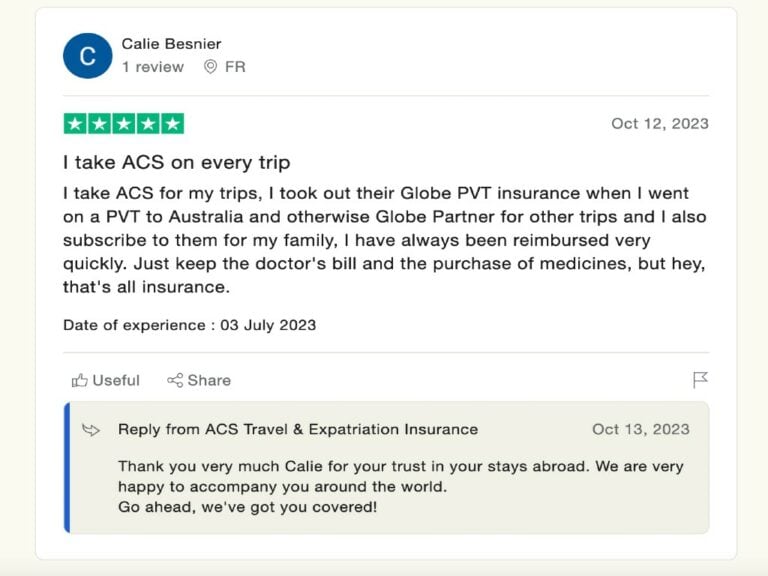

✅ Positive ACS AMI insurance reviews on TrustPilot

- Smooth claims process

- Helpful customer service

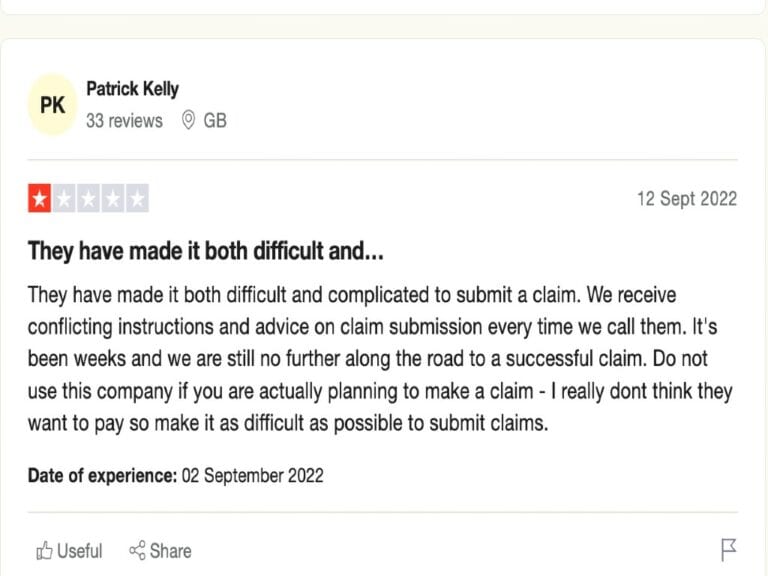

❌ Negative ACS AMI insurance reviews on TrustPilot

- Slow claims payout

- Slow response times

As you can see, there are some conflicting opinions.

After all, 18 reviews aren’t much to go by, so I’m going to cover the best policies ACS has to offer, and then go over some further useful information about their services and discounts.

Which ACS AMI policy is right for me?

After researching and comparing relevant benefits and prices, these are the best ACS AMI policies for each traveller profile in July 2025:

Policy | Discount |

Globe Partner: for short trips and holidays of less than 3 months. | 10% – Activate Discount |

Globe Traveller: for long stays and backpacking trips. | 10% – Activate Discount |

Note that discounts are applied automatically when using our links, and all offers have been verified and updated.

How ACS AMI travel insurance works

Obviously, you don’t want to have to use your travel insurance. However, it can be useful to know what to do in the event of a claim to avoid making the situation worse.

For example, repatriation is sometimes necessary when you are hospitalised following an accident or illness, including accidents at home or the death of a relative. ACS AMI offers effective repatriation coverage in these cases.

If you are hospitalised for more than a week, other benefits will be added, such as the possibility of a relative joining you at the insurer’s expense. In all cases, the logistics and conditions of repatriation are fully covered by ACS AMI.

Here are some guidelines in case of a glitch:

- 🚑 24-hour hospitalisation: you must advance the costs incurred and keep all the receipts for medical and hospital expenses. As well as the invoices for medication in order to send them back to the insurer later to obtain your reimbursement.

- 🏥 Hospitalisation of more than 24 hours: you will have to contact the insurer so that it can contact the hospital where you are being treated. This way, there is no need to make an advance payment for medical expenses.

- 🧳 Luggage theft: the insurer must be contacted within 5 days. The delay may vary depending on the loss suffered.

What are the benefits of ACS AMI travel insurance?

With Globe Traveller, ACS AMI offers the possibility to subscribe even if you have already left home. However, there is a waiting period of 8 days.

This is a huge advantage for travellers who may have forgotten to insure themselves.

ACS AMI also stands out for its affordable prices compared to other similar insurers. Their policies offer great value for money, especially for travellers going on regular, low-risk holidays abroad.

To give you a better idea of what ACS AMI’s policies have to offer, I’ve summarised their main advantages below:

Main benefits of Globe Partner

- 🌎 Valid worldwide

- 💻 Quick and secure online subscription

- 🚑 Customisable medical expenses cover

- 🩺 Free choice of doctors and hospitals

- ✈️ Repatriation assistance and medical transportation

- 🦠 Covid-19 coverage

Unfortunately, Globe Partner is exclusively reserved for those under 40 years of age. If you’re searching for travel insurance options for people above 75, or people with pre-existing medical conditions, click here.

Main benefits of Globe Traveller

- 📞 Multilingual 24/7 helpline

- 📲 Subscribe after your departure

- 📝 Customisable guarantees

- 🏄♂️ Risky sports coverage add-on option

- ✈️ Repatriation assistance and medical transportation

Unfortunately, Globe Traveller is exclusively reserved for those under 66 years of age.

How to contract ACS AMI travel insurance

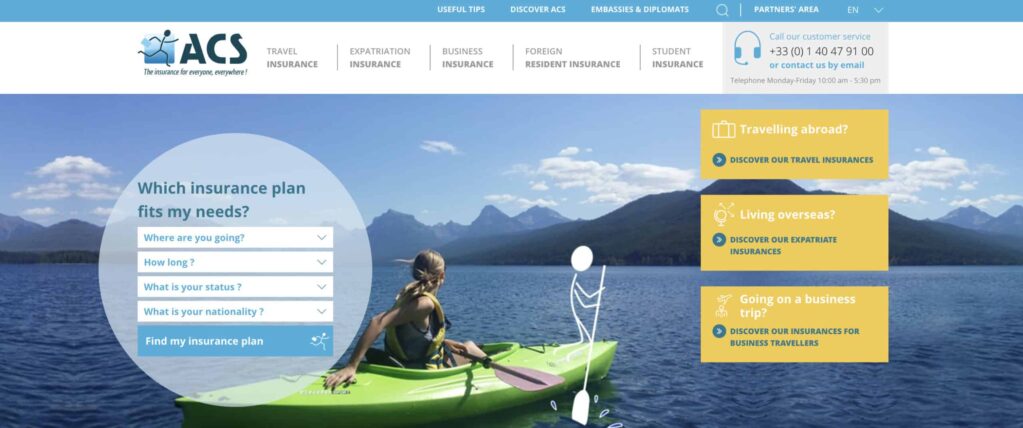

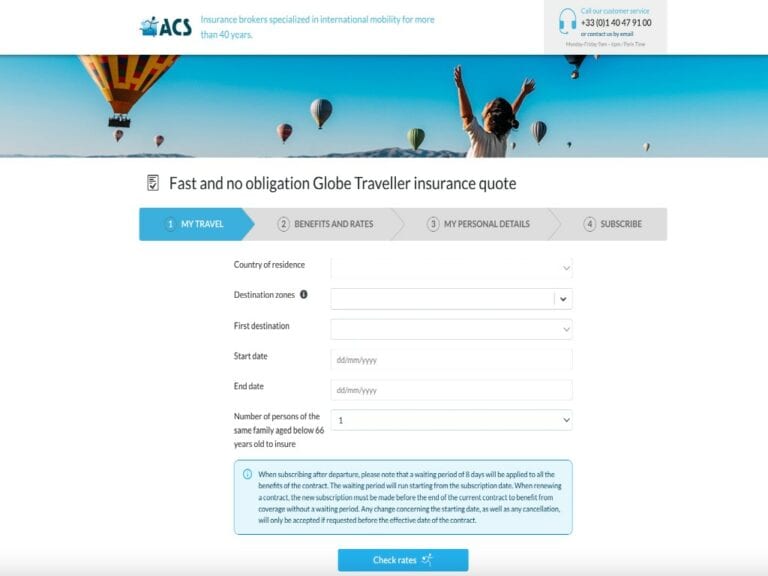

The ACS AMI website is easy to navigate, so you shouldn’t have any problems contracting your insurance.

Here’s a quick step-by-step guide to taking out your policy on the ACS AMI platform:

1️⃣ Go to the ACS AMI Insurance website.

2️⃣ On the homepage, fill in your personal details and trip details.

3️⃣ Select the type of policy you want to contract.

4️⃣ Choose your medical expenses limit and sports coverage add-on if needed.

5️⃣ Fill in your personal details.

6️⃣ Fill in your payment details, and that’s it!

How to reduce the cost of your trip

One thing that all travellers have in common is the desire to save money while travelling. More often than not, to be able to continue travelling!

There are countless ways to make your travels cheaper. Choosing insurance that is tailored to your needs is vital, but remember that flights and accommodation are crucial factors as well.

Here are a few tricks I’ve learned over the years, they’ll help you save money on your travels, so you can focus on the things you enjoy about travelling.

If you follow these tips, you might just find that by the end of your trip, you have enough money left over to explore an extra destination on your route home!

- Find cheaper flights ✈️

You can reduce the cost of any flight thanks to AtlasVPN, which conveniently presents you with the best prices on comparison sites like Skyscanner. Simply relocate your IP address to on the of the following countries, and start your search!

- Turkey

- Malaysia

- Thailand

- India

- Mexico

This tool is usually expensive, but we have an incredible discount for you that you can activate here.

- Find discounted accommodation 🏡

Finding cheap accommodation these days can be a challenge, but with Booking, you can find some great deals.

Booking is the best platform for finding accommodation anywhere in the world. Its main advantage? The many discounts you can get for becoming a Genius member! Register with Booking now to save on accommodation.

My opinion on other insurance companies

If you’re still not convinced, there are plenty of other alternatives are out there! We have tried and tested all the best travel insurance policies and written comprehensive reviews of each of them.

I also recommend checking out our travel insurance comparison article.

|  |  |

|---|---|---|

⭐️⭐️⭐️⭐️⭐️ | ⭐️⭐️⭐️⭐️ | ⭐️⭐️⭐️⭐️ |

Heymondo Insurance | Chapka Insurance | IATI Insurance |

|  |  |

|---|---|---|

⭐️⭐️⭐️ | ⭐️⭐️⭐️ | ⭐️⭐️ |

SafetyWing | World Nomads | ACS AMI |

Frequently asked questions about ACS AMI

What methods of payment are accepted?

ACS AMI accepts payment from all the most secure bank cards. These are: Visa, Mastercard, American Express, and PayPal.

Why take out a policy with ACS AMI insurance?

Some types of Visa Premier or Mastercard Gold bank cards offer ‘travel insurance’ as part of the card contract.

However, this type of insurance does not cover all claims. In most cases, an excess will have to be paid, and medical visits are not covered. This is why this type of insurance is not recommended for travel.

As we have seen, it is important to take out an insurance policy that is perfectly suited to the needs of your trip. Both for the activities you will be doing and for the guarantees in case of a claim.

The packages offered by ACS AMI insurance have the advantage of being both affordable and comprehensive, in covering most unexpected travel situations.

Is taking out ACS AMI travel insurance worth it?

In conclusion, deciding whether ACS AMI is right for you requires some consideration of your traveller needs.

For example, if you’re looking for extensive coverage for a big adventure abroad, it may not be right for you. If so, I recommend you check out our article on Long Stay travel insurance.

However, if you’re looking for an affordable policy for your next holiday, or if you’re already abroad and forgot to take out insurance, then ACS AMI is definitely worth it.

ACS AMI’s policies will provide you with an effective financial safeguard in case something goes wrong, which, at the end of the day, is an invaluable benefit to have as you explore your next destination.

I hope that these ACS AMI insurance reviews has given you the necessary insight you need to reach a decision on insurance. Thank you for reading, and safe travels!