Finding the right insurance policy for your trip isn’t always easy, especially if you suffer from a medical condition. In fact, in some instances, this can make your travel insurance considerably more expensive.

Luckily, there is an online service that can help you, Medical Travel Insurance.

Not only do you want to find a policy that meets your unique travelling needs or pre-existing conditions, but you also want to avoid having to pay extra for coverage you won’t need.

I’ve written this guide for those currently considering searching for a policy through Medical Travel Insurance UK, and by the end of this post, I hope you’ll feel that you have the information you need to reach a decision.

My opinion on Medical Travel Insurance

Having browsed through the Medical Travel Insurance comparison website for a few weeks now, I sense that it’s a game-changing option for those with one or multiple pre-existing medical conditions who need travel insurance.

There is coverage for over 1000 different medical conditions. Simply answer a few questions about your conditions, and Medical Travel Insurance will alert you to whether you need an actual screening.

Following this stage, you will be ready to fill in your trip details and receive a quote from a number of reputable insurance providers that offer coverage for your specific conditions.Then simply make your choice!

Medical Insurance shows you the best policies available on the UK market, dependent on the medical conditions you’ve entered. This is significant because many insurers have limited coverage for medical coverage, or for people above a certain age.

Reviews of Medical Travel Insurance

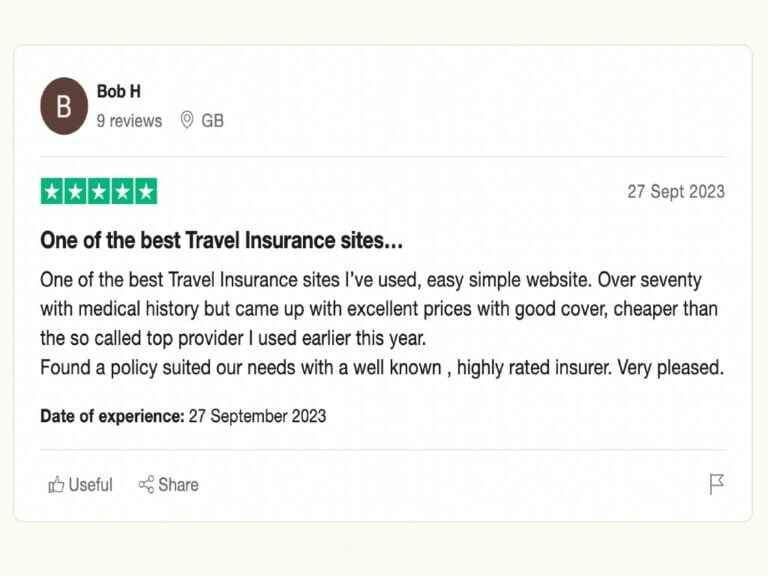

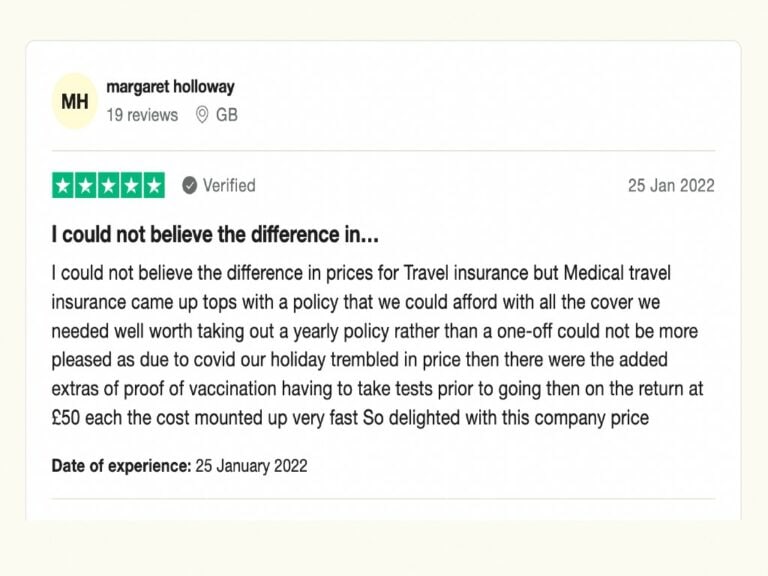

There are over a thousand online reviews of Medical Travel Insurance on TrustPilot, with the overwhelming majority being positive.

To save you some time, I’ve collated and condensed these reviews, but first, let’s look at Medical Travel Insurance’s average rating.

To give you a quick idea of users’ opinions on Medical Travel Insurance, consider their TrustPilot “TrustScore”…

- Medical Travel Insurance scores an average rating of 4.7/5 on TrustPilot. The vast majority of online reviews of Medical Travel Insurance are on this platform.

Note that the “TrustScore” is not simply an average, but also considers other factors, such as the age and frequency of reviews.

Reviews of Medical Travel Insurance on TrustPilot

TrustPilot is one of the world’s leading online review platforms, allowing customers to leave reviews on businesses and their services.

There are currently 1,838 total reviews of Medical Insurance at the time of writing this post. With a TrustScore of 4.7, it’s fair to say that Medical Travel Insurance is a reputable company.

✅ Positive reviews on TrustPilot

- The most common reviews for Medical Travel Insurance were people saying how quick and easy the website was to navigate, and then being redirected to the insurance provider themselves.

- Many users commented that they received great customer service from Medical Travel Insurance’s phone representatives.

- Easy to extend and amend policies based on your needs.

- Shows the best policies with the most competitive rates.

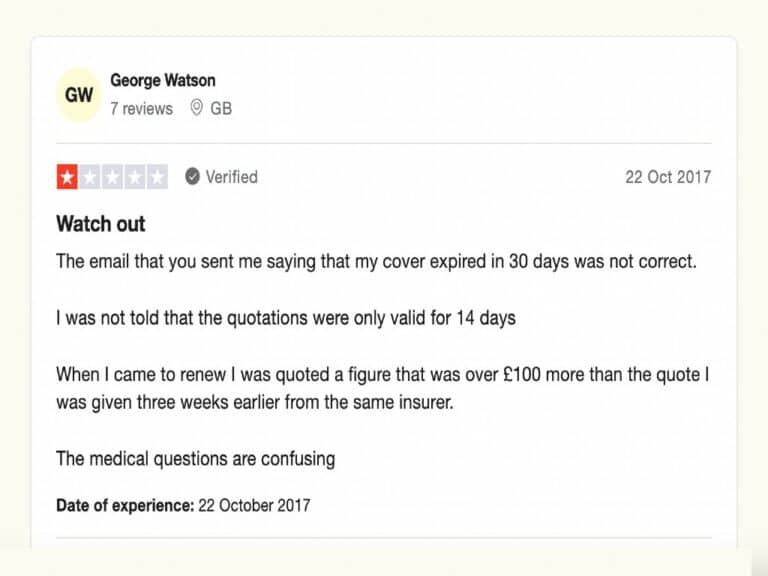

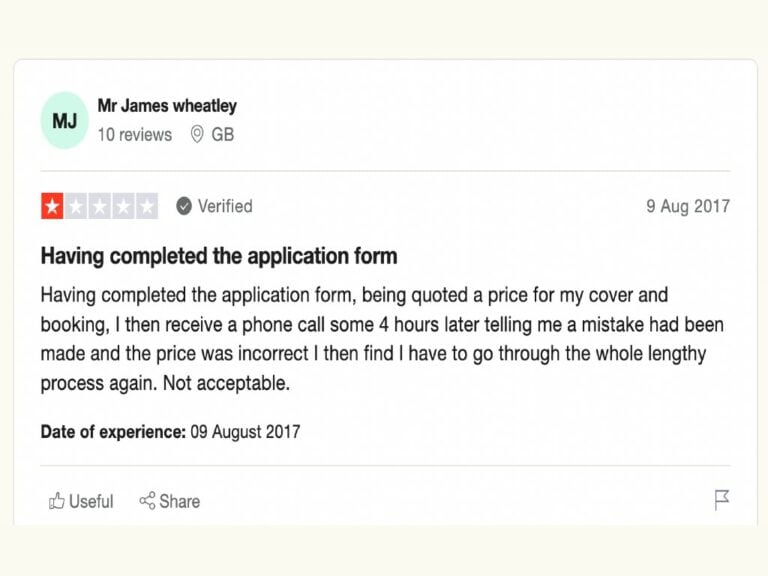

❌ Negative reviews on TrustPilot

- The most common complaints about Medical Travel Insurance concerned unexplained price increases and extra costs.

- Technical issues on the website ended up causing confusion for some users.

From reading through these reviews, one can conclude that most users found contracting a policy through Medical Travel Insurance to be quick and easy, made easier by solutions-oriented staff members.

In fact, I would like to mention that for the number of reviews of Medical Travel Insurance that exist on TrustPilot, a very small portion of them are negative. I must say, this is not particularly common within the world of travel insurance!

There were also a number of positive reviews regarding the claims process, which I can tell you, is quite uncommon for travel insurance companies!

These users recounted a straightforward claim’s process, and quick reimbursement. This suggests that Medical Travel Insurance do their due diligence in selecting insurance providers to feature on their website.

Which Medical Travel insurance policy is right for me?

It can be difficult to find good coverage, particularly if you are in your older years or suffer from a medical condition. Fortunately, there is a way you can quickly and efficiently browse the web for travel insurance that suits your needs.

With Medical Travel Insurance, you can find numerous policy options with broad medical coverage within minutes.

Simply click on one of the official links below, and follow the instructions. You will then be shown all the travel insurance policies that fit your search.

It’s absolutely crucial that you answer all the questions about your medical condition truthfully and accurately, to ensure a successful claim, should you need to make one.

Policy | Official Link |

Single Trip policies: ideal for short trips and holidays of up to 3 months. | |

Annual Multi-trip policies: covers all short-term trips taken in a year. Perfect for frequent travellers! | |

Winter Trip policies: comprehensive coverage for winter and adventure sports trips. | |

Cruise policies: travel insurance with coverage designed for cruise travel. |

Medical Travel Insurance coverage

In this section, I’d like to shift the focus to Medical Travel Insurance’s partners, the companies that Medical Travel Insurance refers you to based upon your medical conditions.

Before you settle on a policy, it’s a good idea to compare the available options, so you can be sure that you’ve selected the most suitable insurance policy for your trip. With Medical Travel Insurance, this is made easy for you!

Here are the amounts of medical coverage offered by Medical Travel Insurance’s partner insurers. Note that when you fill in a quote, Medical Travel Insurance will only show you policies that cover your specific conditions.

Fit2Travel Insurance

- Offers up to £10,000,000 in medical emergency expenses for all policies (Silver, Gold, Platinum).

- Hospital benefit of up to £500 a day for all policies.

- Covers all ages.

Goodtogo Insurance

- Offers up to £10,000,000 in medical emergency expenses for all policies (GTG Gold, GTG Platinum).

- Hospital benefit of up to £1,000 a day for all policies.

- No upper age limit.

Free Spirit Travel Insurance

- Offers up to £10,000,000 in medical emergency expenses.

- Hospital benefit of up to £1,000 a day

- No upper age limit.

- Terminal conditions considered.

Direct Travel Insurance

- Offers up to £10,000,000 in medical emergency expenses.

- With Direct Premier Plus, you have up to £2,000 in hospital benefits, and up to £30,000 in personal accident coverage.

- Some age limits apply, depending on the policy selected.

As you can see, Medical Travel Insurance provides you with alternatives suited to your age and medical condition, so you can save time on researching insurance options!

How Medical Travel Insurance works

Medical Travel Insurance does not provide insurance policies itself. Instead, it’s an online comparative site that saves you time by compiling the best insurance alternatives based on your specific needs as a traveller.

Everyone deserves the chance to travel and see the world, but unfortunately, for people with medical conditions, it’s difficult to find insurance.

Medical Travel Insurance specialises in helping people with pre-existing medical conditions get the coverage they need for their travels.

Once you’ve selected and contracted a policy through Medical Travel Insurance’s website, you will be covered in the event that something unforeseen goes wrong on your trip.

Making a claim

Of course, no one ever wants to have to use their policy to make a claim, but it’s better to be safe than sorry.

If you need emergency medical treatment, transportation of medicines, or if you need to be repatriated while abroad, your insurance company can reimburse you.

Remember to always read your policy’s terms and conditions carefully, so you know exactly what’s covered, and you’ll know what to do in case you need to make a claim.

It’s vital that you declare all your underlying medical conditions at the time of contracting, and keep all supporting documents relating to your incident. If you don’t, you will not be able to recover the costs.

What are the benefits of Medical Travel Insurance?

The most useful feature of their services is the ease at which you can find different policies with high medical coverage, flexibility, little to no age restrictions, and competitive prices.

Many travel insurance providers have low levels of coverage for people with pre-existing conditions and older folks, whereas Medical Travel Insurance covers over 1000 different conditions, including the following:

- Diabetes

- Arthritis

- Asthma

- Cancer

- Strokes

- Epilepsy

- High blood pressure

- Heart conditions

- Bipolar disorder

- Cystic fibrosis

- Multiple sclerosis

- Downs syndrome

If you’re a traveller with any form of special requirements, Medical Travel Insurance is a great service that can point you in the direction of the coverage you need, at a good price.

✅ Advantages of Medical Travel Insurance

- ⏰ Save time looking for insurance that suits your medical condition, and your budget.

- 💻 Ease of navigating the website.

- 📞 Customer Service phone line to assist you and answer your questions.

- 🩸 Over 1000 different medical conditions.

- 🎂 Great alternatives for people over 65 years old.

How to use Medical Travel Insurance

The procedure is simple. Go to the Medical Travel Insurance website, enter your personal and trip details, and within moments you’ll have plenty of policies to choose from, all consistent with any pre-existing condition you may have.

More specifically, here’s a step-by-step guide on how to do it:

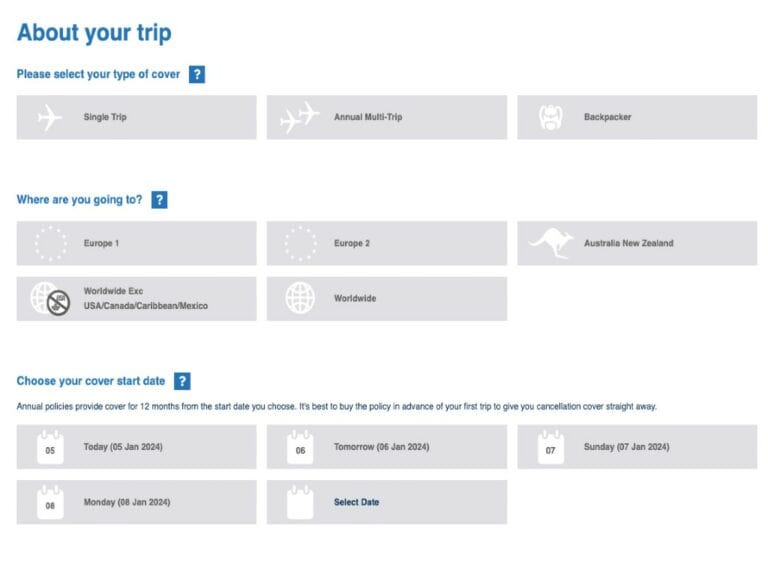

1️⃣ Go to the Medical Travel Insurance website and select the type of insurance you want: (Single Trip, Annual Multi-trip, or Winter Trip).

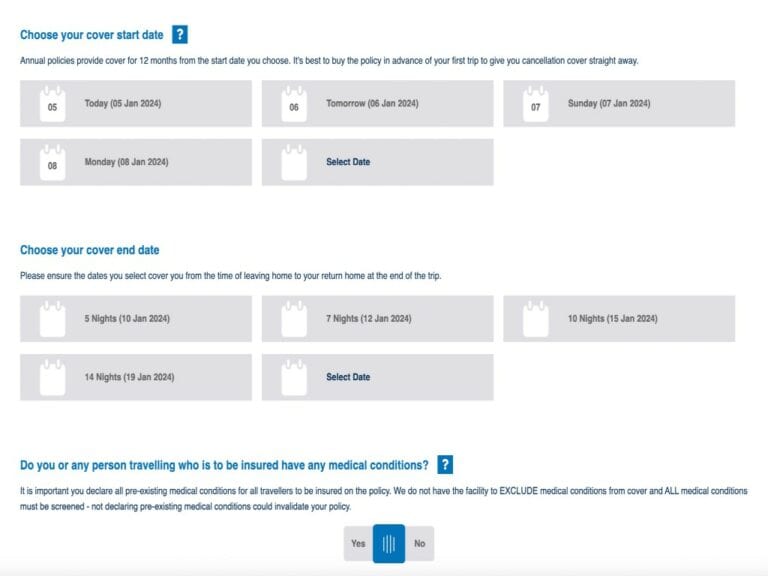

2️⃣ Fill in your trip details: destinations, travel dates, traveller details.

3️⃣ Enter your medical condition(s) and answer a few quick questions.

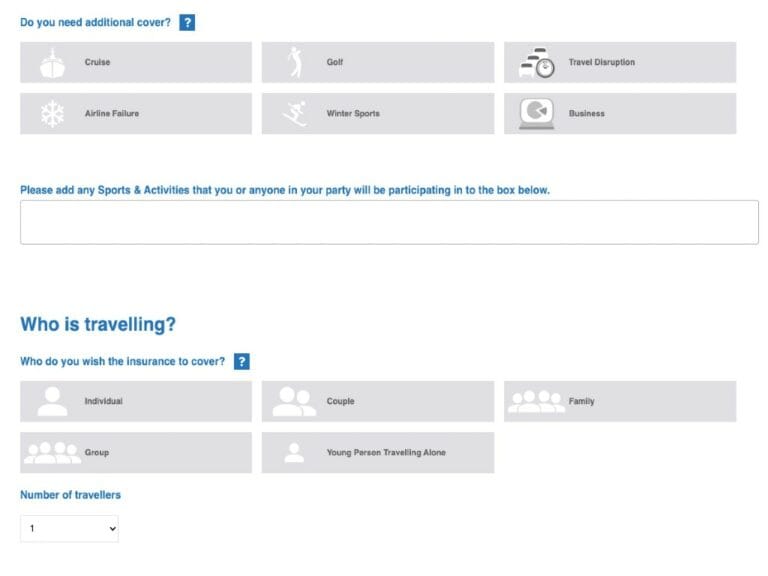

4️⃣ Choose additional cover: winter sports, cruise, travel disruption, airline failure, business, golf.

5️⃣ Select your cover limits: filtrate your search results to get the exact coverage you require.

That’s it! You will be presented with the best available travel insurance policies based on your search.

How to reduce the cost of your trip

One thing that all travellers have in common is the desire to save money while travelling. More often than not, to be able to continue travelling!

There are countless ways to make your travels cheaper. Choosing insurance that is tailored to your needs is vital, but remember that flights and accommodation are crucial factors as well.

Here are a few tricks I’ve learned over the years, they’ll help you save money on your travels, so you can focus on the things you enjoy about travelling.

If you follow these tips, you might just find that by the end of your trip, you have enough money left over to explore an extra destination on your route home!

- Find cheaper flights

You can reduce the cost of any flight thanks to AtlasVPN, which conveniently presents you with the best prices on comparison sites like Skyscanner. Simply relocate your IP address to on the of the following countries, and start your search!

- Turkey

- Malaysia

- Thailand

- India

- Mexico

This tool is usually expensive, but we have an incredible discount for you that you can activate here.

- Find discounted accommodation

Finding cheap accommodation these days can be a challenge, but with Booking, you can find some great deals.

Booking is the best platform for finding accommodation anywhere in the world. Its main advantage? The many discounts you can get for becoming a Genius member! Register with Booking now to save on accommodation.

My opinion on other insurance companies

If you want to learn more about the other insurance options out there, we’re here to help! We have tried and tested all the best travel insurance policies and written comprehensive reviews of each of them.

You can also check out our other travel insurance comparison website reviews:

|  |  |

|---|---|---|

⭐️⭐️⭐️⭐️⭐️ | ⭐️⭐️⭐️⭐️ | ⭐️⭐️⭐️⭐️ |

Heymondo Insurance | Chapka Insurance | IATI Insurance |

|  |  |

|---|---|---|

⭐️⭐️⭐️ | ⭐️⭐️⭐️ | ⭐️⭐️ |

SafetyWing | World Nomads | ACS AMI |

Frequently asked questions about Medical Travel Insurance

What age restrictions are there?

Medical Travel Insurance is a great service for those travellers who are perhaps a little too old, or a little too young, for the traditional insurance policies.

Their aim is to provide coverage for people as old as 99, and provides detailed information for travellers from each age bracket.

Which countries’ residents can use it?

Only UK insurance companies are shown on the website, many of which require applicants to be a United Kingdom resident. The UK, for insurance purposes, typically refers to England, Scotland, Wales, Northern Ireland, and the Isle of Man.

Why use Medical Travel Insurance?

The cost of receiving medical attention abroad can easily get into the hundreds of thousands of pounds, and if you suffer from a pre-existing medical condition, then this risk is increased. But this doesn’t mean you can’t travel and explore the world!

By using Medical Travel Insurance’s services, you can find and contract a policy that will provide you with perhaps the most important benefit of all: financial protection in the event of the worst-case-scenario.

Even if you take all the precautions in the world, it’s simply not worth the risk.

Before you travel, consult your health practitioner and the NHS website for information about your condition or Covid-19.

Is using Medical Travel Insurance worth it?

Medical Travel Insurance is a truly handy website for people with special medical requirements who might otherwise have a tough time finding adequate travel insurance.

Being presented with a wide range of policies that cover your condition can be a big help, and it can also save you both time and money.

At the end of the day, you’ll need to carefully consider what your needs are as a traveller, and whether any one particular policy provides you with a sufficient level of coverage as it concerns your pre-existing medical condition.

However, if you are an older traveller or someone with one or more medical conditions, Medical Travel Insurance is definitely worth taking a look at.

If you are someone who has struggled to find good insurance in the past because of a medical condition, I really hope that this post has given you some insight into the options available to you. Have a safe trip! ✈️