Today’s post is a summary of the online Coverwise Travel Insurance reviews. Our objective is to help you make an informed decision about which insurance policy to choose for your next trip.

Reading online Coverwise reviews will allow you to see how other consumers have rated the company’s services, which is particularly helpful when looking for travel insurance.

To ensure that you’re sufficiently informed about Coverwise Travel Insurance, I’ve also included some general information about their policies and benefits, to help you reach a decision.

Coverwise is a UK-based travel insurance company that stands out for its low prices, and high coverage for medical expenses and accidents.

Coverwise Travel Insurance Reviews

When taking out an insurance policy, you want to be sure that you’re contracting with a reputable provider. That’s why I’ve set out both positive and negative Coverwise reviews.

Here are the average scores of Coverwise on two of the biggest insurance review sites in July 2025:

- Coverwise Travel Insurance has an average rating of 4.7/5 on TrustPilot.

- Coverwise Travel Insurance has an average rating of 4.5/5 on ComparebyReview.

My personal Coverwise Insurance review

A holiday can come to a screeching halt in a matter of seconds, so it’s better to be prepared, in fact, approximately 1 in 3 travellers are forced to resort to their insurance policies at some point.

Selecting a comprehensive travel insurance policy is the best way to protect yourself from a financial nightmare.

My own experience with Coverwise Insurance was positive. Although I feel like their website is outdated in its layout, I found the contracting process easy and straightforward, not to mention their competitive prices.

The fact that Coverwise provides up to £20,000,000 of cover for medical expenses, as well as broad sports activities coverage, makes it a great option for travel to countries with high medical costs, particularly Canada and the U.S.

Coverwise Travel Insurance Reviews on TrustPilot

TrustPilot is one of the world’s leading online review platforms, where millions of consumers read and share reviews on businesses from around the world.

Trustpilot receives almost 1 million new reviews each month, and at the time of writing this post, there are over 69,000 Coverwise Travel Insurance reviews.

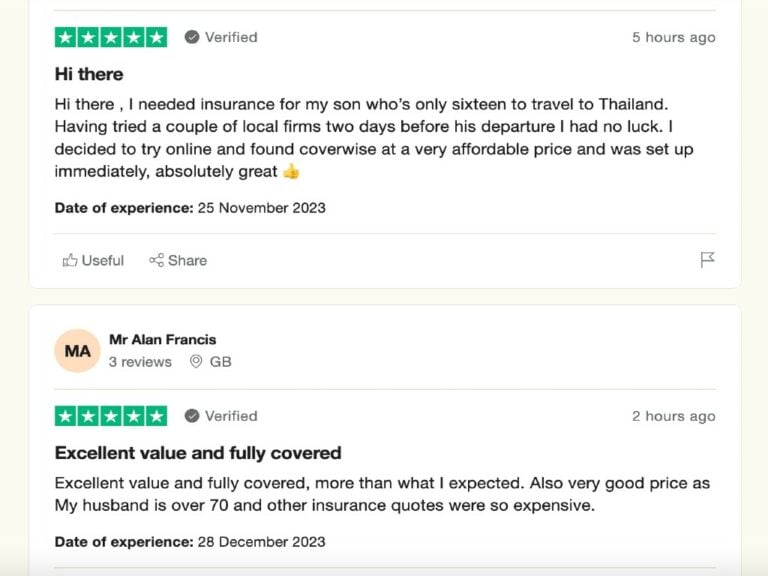

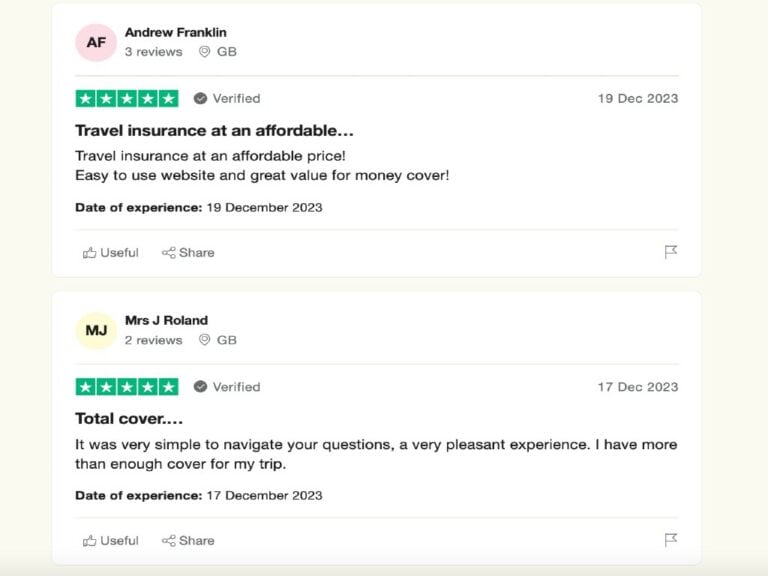

✅ Positive Coverwise travel insurance reviews on TrustPilot

- The overwhelming majority of positive Coverwise reviews concerned how quick and easy it was to contract their policies.

- Many online Coverwise insurance reviews noted the low prices as a stand-out feature, and many users mentioned that Coverwise was the cheapest option on the market.

- There were a number of reviews citing that Coverwise provided great value coverage for over 65s, and that they were able to purchase cheap coverage for their pre-existing conditions.

- Great customer service seems to be a common thread among the online Coverwise travel insurance reviews, with many users commenting that Coverwise’s phone representatives were helpful and took the time to explain things in detail.

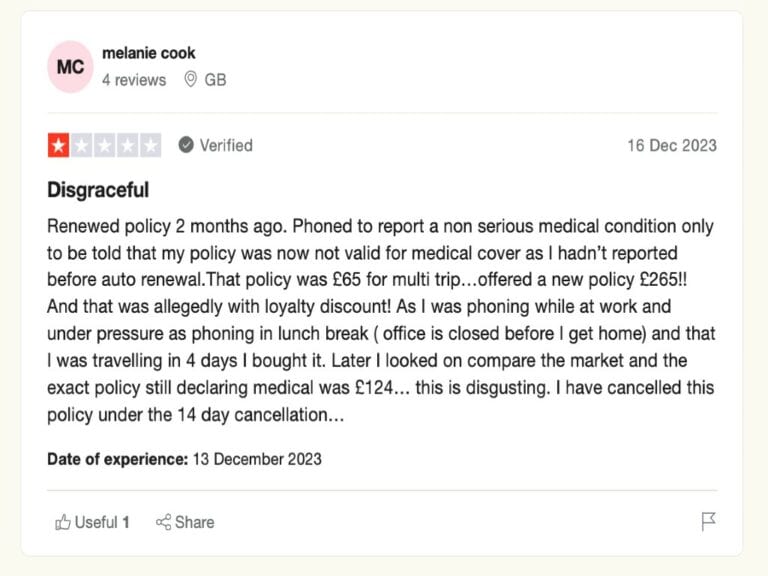

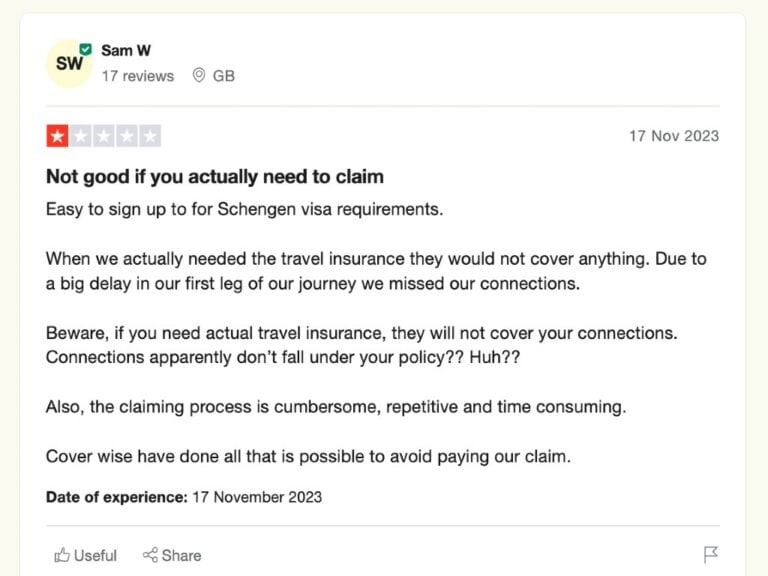

❌ Negative Coverwise travel insurance reviews on TrustPilot

- Many users found the Coverwise website as difficult to navigate, and on some pages, the text was very difficult to read.

- Some users believed that their claims were rejected on unfair grounds, and that there weren’t enough clear steps to follow upon making a claim with Coverwise. It’s worth noting that Coverwise travel insurance is underwritten by AXA.

- A number of users expressed their dissatisfaction with the waiting times for responses regarding claims, which ranged from a few weeks, to a few months.

I was unable to find any positive Coverwise insurance reviews about the claims process itself.

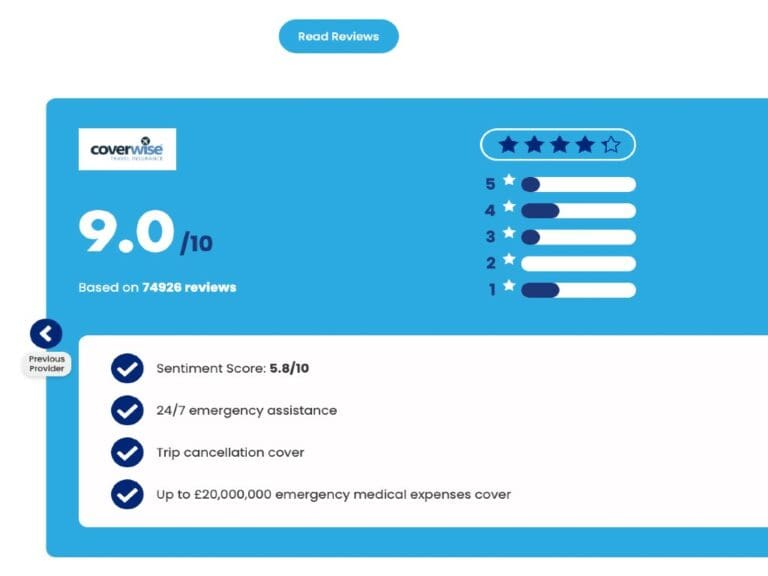

Coverwise Travel Insurance Reviews on ComparebyReview

ComparebyReview is an online review platform that specialises in comparing insurance reviews.

ComparebyReview also provides a sentiment score. A sentiment score is an alternative metric for analysing reviews that evaluate the ratio between positive and negative words in a review, reflecting a more authentic review score.

Coverwise travel insurance received a sentiment score of 5.8/10, but an average score of 9/10.

✅ Positive Coverwise travel insurance reviews on ComparebyReview

- Users were typically pleased with the price they paid for their policy in relation to their coverage.

- Customer service was again a feature in these Coverwise travel insurance reviews.

❌ Negative Coverwise travel insurance reviews on ComparebyReview

- A number of users claimed that their annual insurance policies were renewed without permission, but that they were promptly refunded.

- Users complained about the slow response following a claim, and even upon receiving a response, the correspondence during the claim’s process was said to be difficult and drawn out, particularly when providing proof.

Which Coverwise Travel Insurance policy is right for me?

When in the process of choosing travel insurance, remember to consider the possible risks involved with your trip, and any special requirements you or your companions may have.

Your traveller profile typically refers to the length of your trip, your destinations, as well as your purpose for travel.

Having a good idea of which traveller profile you fit into is crucial when selecting a policy. As such, I’ve set out the best Coverwise travel insurance policies according to each traveller profile in July 2025:

Policy | Official Link |

Single Trip, Coverwise’s short-term and holiday policy for trips of 90 days or less. | |

Single Trip with Winter Sports. | |

Annual Multi-trip, Coverwise’s annual plan covers all trips taken in a year. Perfect for frequent travellers! | |

Annual Multi-trip with Winter Sports, covers all skiing trips of up to 17 days taken in a year. |

Unfortunately, Coverwise does not currently offer a long-term insurance option. The upper limit of Coverwise’s Single Trip Insurance is 90 days, so if you plan to travel for longer than this, you’ll need to find another insurer.

If you’re planning a long-term trip and need insurance, take a look at our article on long stay insurance, where we cover the best long-term policies for each traveller profile.

How Coverwise Travel Insurance works

Finding the right travel insurance can be challenging, but it’s important to remember that taking out insurance provides financial security, and peace of mind, so you can make the most of your trip.

If you end up needing emergency medical treatment, cancellation cover, or cover for lost or stolen belongings while abroad, you can make a claim with Coverwise and recover the costs.

To ensure that your claim is accepted, always declare any underlying medical conditions at the time of contracting, For coverage of pre-existing conditions, you’ll simply need to complete a brief assessment by Coverwise either online or by phone.

If you decide to opt for a Winter sports add-on, for either your Single Trip or Annual policy, you’ll be covered for over 40 different winter activities. Note that with your Annual Coverwise Winter sports policy, you’re only covered for all trips of up to 17 days.

Making a claim with Coverwise Travel Insurance

You should always familiarise yourself with your policy’s terms and conditions before you travel, so you get a strong understanding of what coverage you have. Remember to keep all supporting documents you may need to provide proof of a claim.

If something does go wrong on your trip, you’ll need to start an online claim on Coverwise’s official website. It’s good to initiate this process as soon as possible. Also note that Coverwise has a global medical emergency line that is available 24/7.

What are the benefits of Coverwise Insurance?

From observing the Coverwise insurance reviews, it’s clear that the features that set them apart are their competitive prices, extensive medical coverage, and broad sports coverage.

Also, all Coverwise policies include business travel insurance, insuring you during your business trips.

Coverwise’s Single Trip and Annual policies are designed to facilitate adventure sports, with over 100 activities included, here are just a few to mention:

- ⛳️ Golf

- 🏔 Hiking

- 🏞 River tubing

- 🤿 Scuba diving

- 🏗 Bungee jumping

- 🛶 Kayaking

Coverwise offers up to £20,000,000 of cover for medical expenses, among the highest on the market, a great deal when you consider Coverwise’s low prices. Always abide by the safety regulations, like using a helmet, for example, as this may affect your claim.

Furthermore, Coverwise’s policies include useful Covid-19 coverage, including trip cancellation, trip curtailment, and medical coverage for the virus. It’s important to note that for a claim to be accepted, you must not travel against FCDO recommendations.

How to contract Coverwise Travel Insurance

1️⃣ Go to the Coverwise Travel Insurance website and select the type of insurance you want:

2️⃣ Fill in trip details: destination, travel dates, traveller details, medical declarations (important).

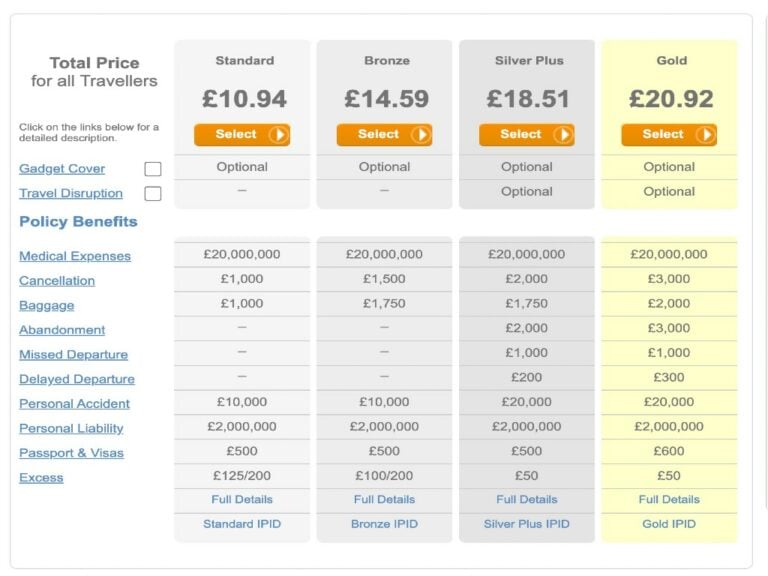

3️⃣ Choose your plan, from least to most coverage: Standard, Bronze, Silver Plus, and Gold.

Note that the quote shown below is just an example. Head over to the official Coverwise website to fill in your own quote!

4️⃣ Choose additional cover: Gadget cover (good for digital nomads), or Trip Disruption cover.

5️⃣ Enter your payment details.

That’s it! You’re ready to travel.

How to reduce the cost of your trip

One thing that all travellers have in common is the desire to save money while travelling. More often than not, to be able to continue travelling!

So, let’s take a step back from our Coverwise travel insurance review to take a look at some money-saving tips.

There are countless ways to make your travels cheaper. Choosing insurance that is tailored to your needs is vital, but remember that flights and accommodation are crucial factors as well.

Here are a few tricks I’ve learned over the years, they’ll help you save money on your travels, so you can focus on the things you enjoy about travelling.

- ✈️ Find cheaper flights

You can reduce the cost of any flight thanks to AtlasVPN, which conveniently presents you with the best prices on comparison sites like Skyscanner. Simply relocate your IP address to on the of the following countries, and start your search!

- Turkey

- Malaysia

- Thailand

- India

- Mexico

This tool is usually expensive, but we have an incredible discount for you that you can activate here.

- 🏨 Find discounted accommodation

Finding cheap accommodation these days can be a challenge, but with Booking, you can find some great deals.

Booking is the best platform for finding accommodation anywhere in the world. Its main advantage? The many discounts you can get for becoming a Genius member! Register with Booking now to save on accommodation.

My opinion on other insurance companies

If you want to learn more about some of the other insurance options out there, we’ve got you covered.

There are plenty of other reliable insurers, it just takes a little time and effort to find the one that best meets your needs as a traveller.

We have tried and tested all the best travel insurance policies on the market and written reviews on each of them, which you’ll find throughout our blog.

Feel free to check out our travel insurance comparison article to compare the top policies to find the one that best suits the type of trip you’re taking.

|  |  |

|---|---|---|

⭐️⭐️⭐️⭐️⭐️ | ⭐️⭐️⭐️⭐️ | ⭐️⭐️⭐️⭐️ |

Heymondo Insurance | Chapka Insurance | IATI Insurance |

|  |  |

|---|---|---|

⭐️⭐️⭐️ | ⭐️⭐️⭐️ | ⭐️⭐️ |

SafetyWing | World Nomads | ACS AMI |

FAQs about Coverwise Travel Insurance

What are the means of payment for Coverwise Insurance?

Coverwise receives payment by card. Once you have arrived at the payment stage, you will be given the option of paying with either Visa, Visa Electron, Mastercard, Delta, or Maestro.

Why take out a policy with Coverwise Travel Insurance?

Some of the most useful coverage provided by Coverwise includes high medical coverage, cancellation coverage, trip curtailment, loss or theft of belongings, and much more.

Coverwise policies also include passport & visa coverage, which covers reasonable accommodation and transport costs incurred to replace lost or stolen passports or visas.

Coverwise has a 24/7 medical help line. Having a policy that offers financial security is crucial, but it’s also important to know that you can call your provider at any time and receive assistance, especially when travelling in a foreign country.

Is taking out Coverwise Travel Insurance worth it?

Coverwise is easy to contract, provides extensive medical coverage, all for a great price. In other words, Coverwise Travel Insurance offers great value for money.

Reading Coverwise reviews is a good way to gauge users’ real-life experiences with their policies. However, it’s essential that you also read the terms and conditions of your policy carefully, so you’re not met with any nasty surprises if something goes wrong.

Ultimately, the answer to whether Coverwise Travel Insurance is right for your trip depends on the specific needs. Remember that the ideal policy for someone else might not be right for you, and vice versa.

Taking out insurance provides you with crucial financial protection, and peace of mind. Thus, I hope that this Coverwise Insurance review has helped you reach a conclusion. Safe travels! ✈️