The experience with some traditional banks can quickly turn into a nightmare, especially if you’re travelling abroad, and you realise you’ve been paying for multiple withdrawal fees that you didn’t know you’d be charged for.

In this N26 Smart review, we’ll take a deep-dive into how this new age online bank works.

What are its advantages and disadvantages? What are the best alternatives to N26 Smart? The purpose of this N26 Smart review is to help you decide for yourself whether N26 Smart is really worth it. So, let’s get into it!

Official N26 website: https://www.n26.com

Since its launch in Europe, the N26 bank has continued to expand and improve its plans. There are now two types of accounts: for individuals and for micro-businesses.

N26 cards for individuals

N26 offers 4 accounts for individuals:

| Metal | You | Smart | Standard |

|---|---|---|---|---|

|  |  |  | |

16,90 € | 9,90 € | 4,90 € | 0 € | |

Voir offre | Voir offre | Voir offre | Activer compte gratuit | |

Retraits en Europe | Gratuits et illimités | 5 gratuits /mois en € | 5 gratuits /mois en € | 3 gratuits /mois en € |

Retraits hors Europe | Gratuits et illimités | Gratuits et illimités | Gratuits et illimités | 1,7% du montant |

Paiements | Gratuits | Gratuits | Gratuits | Gratuits |

Accès Lounge 1000 aéroports | ✅ | ❌ | ❌ | ❌ |

SmartWatch | ✅ | ✅ | ✅ | ✅ |

Couverture Covid-19 | ✅ | ✅ | ❌ | ❌ |

Cartes virtuelles | ✅ | ✅ | ✅ | ✅ |

Assurance voyage | ✅ | ✅ | ❌ | ❌ |

Évaluation | Avis N26 Métal | Avis N26 Smart | Avis N26 |

N26 account for microentrepreneurs

N26 offers 4 accounts for microentrepreneurs:

| Métal | You | Smart | Standard |

|---|---|---|---|---|

|  |  |  | |

16,90 € | 9,90 € | 4,90 € | 0 € | |

Voir offre | Voir offre | Voir offre | Activer Compte Gratuit | |

Retraits UE | Gratuits & illimités | Gratuits & illimités | 5 gratuits /mois | 3 gratuits /mois |

Retraits hors UE | Gratuits & illimités | Gratuits & illimités | Gratuits & illimités | 1,7% du montant |

Paiements | Gratuits | Gratuits | Gratuits | Gratuits |

Change au taux réel | ✅ | ✅ | ✅ | ✅ |

Assurance voyage | ✅ | ✅ | ❌ | ❌ |

Cashback | 0,5% | 0,1% | 0,1% | 0,1% |

Offres partenaires | ✅ | ✅ | ✅ | ❌ |

Évaluation | Avis N26 Business Metal | Avis N26 Business You | Avis N26 Business Smart | N26 Business Standard |

N26 recently announced the launch of a new account: N26 Smart. As well as future improvements to existing accounts.

In this N26 Smart review, we’ll take a look at the features of this new account.

How does N26 Smart work?

The new N26 Smart account was launched on 30 November 2020. This account offers most of the benefits found in the other premium accounts, N26 You and N26 Metal, but at a much cheaper rate.

N26 Smart is priced at €4.90. The N26 You account costs €9.90, while N26 Metal costs €16.90.

N26 Smart is an account for individuals, and N26 Business Smart is designed exclusively for micro-businesses.

Advantages and disadvantages of N26 Smart

Advantages Advantages |  Disadvantages Disadvantages |

| There is no charge for making payments. | The monthly fee is €4.90. |

| Allows you to pay anywhere in the world in any currency. | |

| Up to 5 cash withdrawals in any country free of charge. | |

| Up to 10 subaccounts. | |

| The rounding function saves automatically. |

A good compromise if you travel

The Smart account is linked to a MasterCard debit card, which you can use to make free payments anywhere in the world.

This is a huge advantage if you’re an avid traveller. In fact, the N26 Smart card is not only used to pay in euros, but can also be used in many other currencies.

This account, like the other N26 accounts, is ideal for travel.

You can make up to five cash withdrawals completely free of charge, anywhere in the world, with any additional withdrawals costing €2. There is a limit on the amount you can withdraw, but five withdrawals per month are generally more than enough.

Finally, the N26 Smart card can be personalised in one of five available colours: aquamarine, ocean, sand, graphite, and grapefruit.

Save and better control your money

The N26 Smart account also offers several features to help you better manage and control your money.

The most important, in my opinion, is the possibility of creating up to 10 subaccounts. Thanks to these, you can allocate part of your money to specific expenses and save without realising it!

For example, you could have a main account and dedicate a subaccount to specific expenses. This way, you’ll be able to transfer the total amount you need to pay without worrying about overspending, and save the rest.

You can also personalise your subaccounts, assigning names to each according to the objectives you give them.

Payments with N26 Smart

You can send your payments directly to this subaccount so that it is automatically paid when the cut-off day arrives.

N26 Smart offers another very useful feature for subaccounts: you can share any subaccount with other N26 customers. In this way, you can manage some of your funds with your partner or with a friend.

With the “Round Up” option, you can use one of your subaccounts to create a small piggy bank. For example, if the payment amount is €19.40, N26 will debit €20 from the main account and transfer €0.60 to the subaccount you specify.

The advantage is that all your purchases or transactions will be rounded up to the nearest euro and the rest will go into the savings account you’ve created for your projects!

N26 Business Smart for businesses

☝️ Only microentrepreneurs and the self-employed can open an N26 Business Smart account.

The bank does not accept subscriptions to its offer. If you have another legal status and are not a microentrepreneur, then I recommend Qonto for businesses, which will meet your needs much better.

The N26 Business Smart account offers all the features of the individual account that we have already covered in this N26 Smart review, such as the MasterCard debit card, subaccounts, and rounding.

It also offers other advantages that may be of interest to some…

Cashback on your purchases and transfers

To help you generate more income, N26 Business Smart automatically refunds 0.1% of all payments you make with your debit card.

This amount is deposited into your main account every month. This way, you’ll earn a small profit from your purchases.

When you make payments, whether domestic or international, you can use Money Beam. This tool, specially designed by N26, allows you to make or request SEPA transactions.

The N26 Business Smart account also has the advantage of incorporating more specific options to help you better manage your business.

You can schedule automatic transfers between the main account and the subaccounts, at the frequency you choose: daily, weekly, fortnightly or monthly. What’s more, you can organise your business expenses more efficiently.

Statistics function

If you need to keep a more detailed record of all your expenses, you have a powerful tool at your disposal: Statistics.

With Statistics, you can classify all your account movements, so you know exactly how much you’re spending and on what.

You can also download your complete record, as a PDF or CSV file, to get an overview of the account. You can also add labels to transactions.

✅ Advantages

- 0.1% cashback (only in France)

- Spending categorisation

- Transaction export function

- No commission

- Affordable or free rates

- Mobile application ergonomics

- Activity tracking features

❌ Disadvantages

- No cheque book or cheque deposit

- The offer is only available to microentrepreneurs

- The account is a German IBAN (DE)

- No authorised overdraft available (coming soon)

What is N26?

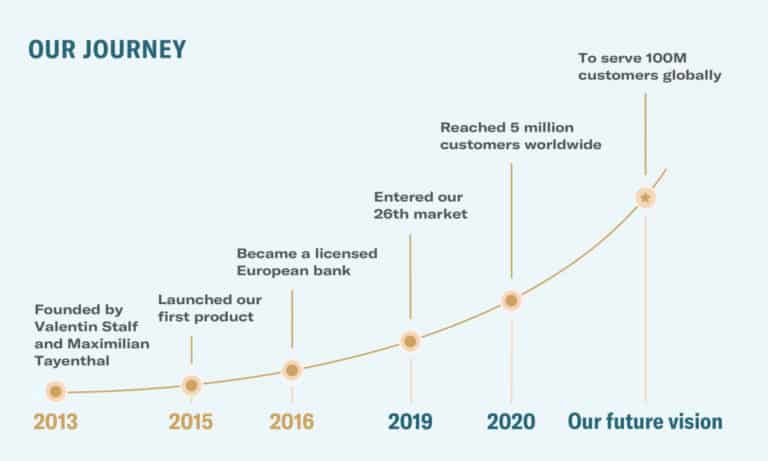

N26 is one of Europe’s oldest and most popular neobanks. It launched operations in Germany in 2013 and has been growing ever since.

In July 2019, N26 raised $170 million from investors and continues to expand in the US and Brazil.

This neobank has expanded on all fronts. It is currently available throughout Europe and in countries on other continents such as America, Asia, and Africa.

By June 2019, the bank already had 3.5 million customers, spread across all the countries in which it operates. In that year alone, the number of users grew by 2.5 million, and in January 2020 it topped 5 million.

N26 Smart reviews

On Trustpilot, N26 has a rating of 3.1/5, based on the reviews of over 27,000 users.

Some users highlight the speed with which processes and operations are carried out by N26. These very positive comments mainly relate to account management and the associated functionalities.

There are also some glowing reviews of the mobile application, which is seen as very intuitive and fast.

Finally, as an online bank, N26 devotes a great deal of effort to strengthening and improving its services.

Negative reviews

However, there are also several very negative reviews on the Trustpilot forum. Most of them state that the bank, after asking them for their documents, refused to open their account.

In my opinion, the bank is very clear about the requirements for opening an account, and if the customer does not meet them, it is possible for the bank to refuse to provide its services.

The bank responds to these negative comments on the forum by asking for more information about the users concerned. This is a way for the bank to improve its image by offering a solution for every individual.

My opinion of N26 Smart

N26 is one of the best neobanks on the market today. That’s why I’ve been using it ever since it was launched. The free Standard N26 card lets you discover N26’s services without paying a cent, which is a huge plus.

The “premium” N26 You and N26 Metal accounts offer numerous advantages that are often unavailable from other neobanks, while remaining reasonable in terms of their charges.

Finally, as we saw in this N26 Smart review, the new N26 Smart account offers most of the features of the premium accounts (You and Metal) at a much lower cost.

Despite the services only found in the premiums, such as travel insurance, the service/price ratio is excellent.

The N26 Smart and N26 Business Smart cards can be used as a bank card for travel. Compared with the competition from N26, this is certainly one of the best options and by far the most affordable.

Best alternative to N26 Smart

N26 Smart vs Wise

For a full assessment, I invite you to read my review of Wise.

Wise is one of the most popular neobanks in Europe and one of the pioneers in this field, alongside N26. Wise started operations in 2011 in the UK and can now be used worldwide.

Its platform helps manage a large number of currencies and make transfers between them, directly in the application.

Wise offers a debit card and a credit card, with which you can pay abroad or withdraw money from ATMs. Withdrawals are limited to £200 per month, while in the case of N26 the limit is in number of transactions.

Both options are very useful and cheap for travellers, but N26 Smart offers more options to manage and control your money.

Official website: https://www.wise.com

Frequently asked questions about N26 Smart

Is the N26 Smart account free?

No. This account costs €4.90 per month.

Does the N26 Smart account charge any fees?

There are no fees for making payments or for the first five cash withdrawals of the month.

How do I open an N26 Smart account?

The N26 platform is very simple to use, as we have seen in this N26 Smart opinion article. The process of opening an account is just as quick.

All you need to do is meet the requirements, such as being of legal age, residing in one of the countries in which it operates, and having a tax identification number.

To open an N26 Smart account, it is important that you do not already have an account with this bank. Here’s a quick step-by-step:

- Go to the official N26 page or application.

- Enter your e-mail address, your personal details, and your address.

- Validate your identity and link your smartphone to the account.

- Make your first deposit, with limits of between €20 and €150.

- And that’s it! In a few days, you’ll receive your MasterCard at the address you provided.

Can I get the N26 Smart account if I already have an account with this bank?

This account is reserved for new customers. You cannot buy it if you have already taken out a product.

What cards does the N26 Smart account offer?

It offers a MasterCard debit card. What’s more, you can choose from five colours: aquamarine, ocean, sand, graphite or grapefruit, so you can pick the one that suits you best.

Can I withdraw cash abroad with my N26 Smart account?

You can withdraw money up to five times a month free of charge, wherever you are in the world.

Can I make payments abroad with my N26 Smart account?

As we’ve seen in this N26 Smart review, you can make payments with your MasterCard in any country and with any currency, without any associated costs.