If you travel regularly, you know that dealing with exchange rates and transfers from abroad can be a real headache!

If you aren’t much of a traveller, perhaps you ended up here because you can’t stand paying the abusive commissions charged by your traditional bank…

I started looking for ways to save on bank charges. My aim was to find a bank that was easy to use, accessible from any country, and cost-effective.

I’ve now been using N26 for 5 years, and so, I decided to make an N26 review!

Official website: https://n26.com

N26 advice on offers for individuals

There are currently 4 cards available for personal accounts. The N26 card covers most of your daily needs:

N26 review: my opinion

It was during my trips to Thailand and the United States that I realised the staggering costs associated with using my previous bank’s bank card.

Naive as I was, I trusted my banker and the card he had recommended to me for travelling. I withdrew cash from ATMs and paid for my purchases with this card.

I was soon disillusioned when I received the account statements! In reality, I was paying constant exchange commissions and exorbitant fees were deducted for each transaction.

N26 cards for individuals

Here are the two N26 premium cards recommended for individuals:

- The N26 You card – €9.90/month.

- The N26 Metal card – €16.90/month.

Both cards offer benefits and discounts:

- 50% off Lime scooter hire

- Free office space booked once a month in any WeWork space worldwide

- Preferential rates on accommodation booked on the Hotels.com platform

- Exclusive discounts on leisure activities and visits offered by GetYourGuide.com

Details of the savings made with my N26 card abroad in 1 year of use💰

- Payments: €14,400 x 2% = €288.00

- Withdrawals: €3840 x 9% = €345.60

- International option: €264.00

- Annual CB subscription: €50.00

Total savings: €947.60

👉 In 1 year, I’ve saved around €947.60 in bank charges, bankcard subscription and withdrawal fees.

What I liked about the N26 card

I realised that most of the customers of this neobank had been swayed by their simplified banking experience and lack of hidden fees.

Here’s a list of the reasons why I started using my N26 card rather than my previous bank’s card:

- Paying with my traditional bank card cost me 2% commission for each payment abroad. With the N26 card, it’s free.

- With my traditional bank card, withdrawing money abroad involved between 7 and 11% commission, depending on the country.

- With the N26 card, I’m entitled to 5 free withdrawals a month. The international option cost me €264/year. With the N26 card, it’s free.

- The international bank card from my traditional bank cost me €50/year. The standard N26 card is free and without any further obligations.

You can get an N26 account for free to save on your banking fees.

To get started, click here: Activate Free N26 Account

- You will be redirected to the official N26 website.

- Click on “Open a free bank account”.

- Fill in the form and follow the instructions.

You’re done! You can now use your free standard N26 bank account.

N26 reviews and N26 card guide

The neobank N26 is a great solution for all my needs today. Indeed, I use the N26 card a lot for its functionalities and its simple and intuitive app.

I’ve had the opportunity to evaluate and put the N26 bank to the test during trips to Asia, Europe and Latin America…

As I explain in this N26 review article, the N26 bank currently has an account offering the best cost-benefit ratio on the market.

For digital nomads or people who travel a lot, the N26 You card is a good option.

Although you’ll have to pay a monthly instalment, in the end it saves you much more than the amount you invested. All the while guaranteeing premium security when you travel.

How does the N26 card work?

All N26 cards are debit Mastercards, which means that they have a higher acceptance rate than prepaid cards. They are not credit cards for which you have to pay every month.

All transactions are carried out in real time and debited directly to the N26 account. The advantage of a debit card is that there is no risk of going over the limit or having to pay interest.

Advantages of N26 cards

- 👨💻 Account management via computer or app (other neobanks only offer the app).

- 💸 Commission-free payments in all currencies and all countries.

- 👍 International transfers 8 times cheaper than a traditional bank.

- 💸 No account maintenance fees.

- 👨💻 Compatible with Apple Pay and Google Pay.

- 🧘♀️ Allianz travel insurance included with N26 You and Metal cards.

- 📲 The simple, intuitive application for managing your account.

Controlling finances and spending

With other banks, purchases made abroad did not include any information or the name of the location. Finally, they did not distinguish by spending sector: food, clothing, restaurants, etc.

With the N26 card, tables divided into sectors are available. This makes it easy to control spending.

Another highlight is the ability to lock the card, to disable payments online and abroad. You can also set up daily limits in just a few clicks directly in the app.

Payments abroad with the N26 card

The N26 card is a Mastercard accepted worldwide. It offers an excellent exchange rate on all currencies. If you live in Europe, it’s even better. As the account is in euros, all you need to do is fund your N26 account in euros to pay your expenses anywhere, free of charge.

N26 also offers superb banking solutions for micro-businesses and online entrepreneurs.

N26 Metal card

The Premium World Elite card with lounge access and Allianz travel insurance

The N26 Metal card is the “Premium” version of the offer. It is a top-of-the-range World Elite card. The N26 Metal card has all the advantages of the N26 You card, plus other exclusive services:

- Concierge service

- Travel insurance

- Access to 1,000 airport lounges worldwide (KeyLounge)

- Dedicated customer service

- Mobile phone insurance

Recommended for business travellers requiring top-of-the-range service.

Summary of advantages

- Comprehensive travel insurance.

- Medical expenses covered abroad.

- Flight delay.

- Stolen mobile phone insurance if purchased with the N26 card. Reimbursement for the phone.

- Luggage allowance.

- Qualified purchases made as an N26 are insured in the event of theft or damage.

- If you are the victim of a mugging less than 4 hours after withdrawing money with your N26 You card and the money is stolen, a refund may be requested.

- Instant transfers and real-time notifications.

- Personal updates and expense reports.

- Transfers 8 times cheaper in foreign currencies thanks to integration with Wise.

- Card activation/deactivation function.

- Statistical analysis of expenses.

- Free international transfers in 19 currencies.

- Payments with Apple Pay and Google Pay.

- Real-time mobile phone notifications with transactions made on the bank account.

- Secure fingerprint access.

N26 You card

A premium account including travel insurance for €9.90

The N26 You card offers all the advantages of a premium account, including travel insurance for travelling anywhere in the world. Having this travel insurance built into the N26 You card means you can deal with any problems that may arise when travelling.

In fact, the N26 You card covers expenses such as medical costs, lost luggage, and even theft that occurs up to 4 hours after money has been withdrawn from the account.

What’s more, the N26 You card’s travel insurance reimburses you for flight delays of more than 4 hours and baggage delays. To see all the travel insurance benefits, click here.

Another advantage is that if you buy a mobile phone with your N26 You card and it is stolen, you will be reimbursed.

Summary of advantages

- Full travel insurance: see all cover

- Medical expenses covered abroad.

- Coverage for flight delays.

- Stolen mobile phone insurance if purchased with the N26 card. Reimbursement for the phone.

- Luggage allowance.

- Qualified purchases made as an N26 are insured in the event of theft or damage.

- If you are the victim of a mugging less than 4 hours after withdrawing money with your N26 You card and the money is stolen, a refund may be requested.

- Instant transfers and real-time notifications.

- Personal updates and expense reports.

- Transfers 8 times cheaper in foreign currencies thanks to integration with TransferWise.

- Card activation/deactivation function.

- Analyse expenses incurred using statistics.

- Free international transfers in 19 currencies.

- Payments with Apple Pay and Google Pay.

- Real-time mobile phone notifications with transactions made on the bank account.

- Secure fingerprint access.

Free N26 card

A card to save when travelling: N26 free and with no commitment

If you’re not quite sure what to choose, N26 offers the possibility of “testing” its banking services. This is a good option for discovering N26’s services or for starting to save on your bank charges.

With the N26 MasterCard debit card, you can carry out all transactions as with any other card. You’ll have access to all movements thanks to push notifications that arrive the same second as the purchase is made. You will have complete control over your account at all times.

The N26 Standard card is accepted all over the world and on websites where Mastercard is accepted.

Summary of advantages

- The account is valid for an unlimited period.

- Real-time notifications and instant transfers.

- Expense reports with hashtags and fully personalised updates.

- International transfers using Wise technology.

- Free payments available in 19 currencies.

- There are no minimum requirements for use.

- Free ATM cash withdrawals 5 times a month. 2 for each additional withdrawal.

- Withdrawal in foreign currency: commission of 1.7% of the value.

It may seem strange, a bank card and account that are totally free… But it’s true: the N26 card is free. For each payment made, the bank receives a commission of between 0.5% and 1.5% of the amount collected by the shop.

However, you don’t pay more. In fact, it is the merchant who pays the commission to the bank and Mastercard. This explains why most shops require a minimum of €10 to pay by bankcard.

Please note that this card does not include travel insurance.

How do I get an N26 card?

Opening an N26 account is quick and easy. It takes an average of 8 minutes. All you need to open an account is a smartphone equipped with a camera and Internet access.

Step-by-step guide

- Go to the N26 website by clicking here, then choose the offer that suits you by clicking on “Open free bank account”.

- Complete the registration

- First name and surname

- Valid email address

- Valid mobile phone number

- Postal address

- Date of birth

- Nationality and country of birth

- Confirm the e-mail address used for registration.

- Select the type of account you require.

- Provide proof of identity. To do this, you need to take a photo of your passport and a selfie, all directly from the application. In this way, the N26 bank will assess whether the document is correct.

- Almost there! Once you have confirmed that your account has been created, you will be able to use the account.

Make a 1st deposit on an N26 account

To activate your N26 account, you need to make a deposit by bank transfer. Simply make the transfer from your current account to your new N26 account. This operation is quick. It takes about 24 hours.

Requirements for opening an account

- Be over 18 years of age.

- You must have a telephone compatible with the N26 application to carry out transactions.

- Be in possession of a passport or identity card.

- Not have a previous N26 account, as only one account can be opened per person.

- Have a home address in one of the 22 countries where N26 is supported. N26 will send the bank card to residential addresses in all eurozone countries except Cyprus and Malta. It is therefore necessary to have an address in one of these countries. As proof of residence is not required, it is possible to use the address of a family member, friend or acquaintance living in one of these accepted countries.

List of accepted countries

- Austria

- Belgium

- Estonia

- Finland

- France

- Germany

- Greece

- Iceland

- Ireland

- Italy

- Latvia

- Lithuania

- Liechtenstein

- Luxembourg

- Netherlands

- Norway

- Portugal

- Poland

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

N26 You is not available in Greece, Slovenia, Sweden, Norway, Denmark, Poland, Iceland, or Liechtenstein.

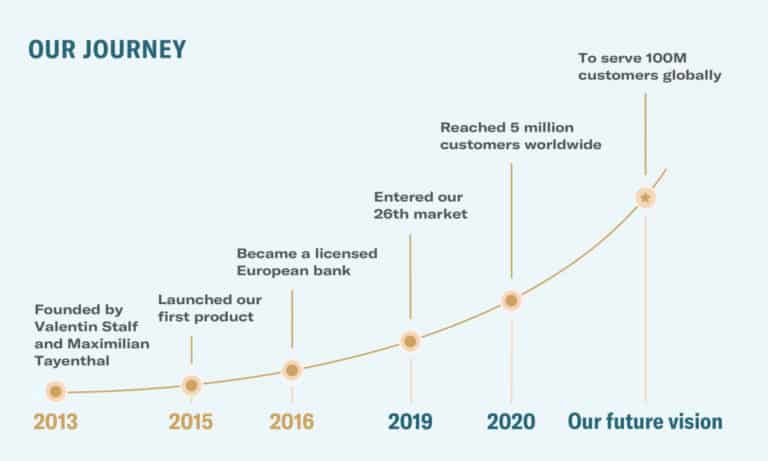

What is N26 Bank?

The beginning of the 2010s saw the arrival of fintechs, with a host of innovative new banking offerings. Perfect for the development of a sector that used to be run by large, well-established groups with little inclination to innovate.

The N26 bank is a fintech of German origin that began operations at the beginning of 2013. With a banking licence, this neobank is present in 17 European countries. N26 Bank is a brand of Berlin-based N26 Bank GmbH.

Only a few years after its creation, N26 has consolidated its position as Europe’s leading online bank. Its growth is accelerating and every day 3,000 new customers open an N26 account. At the time of writing, N26 has passed 5 million customers worldwide.

In the following graph, you can see the extent of N26’s impressive rise.